04

Climate change

Climate change and the urgent need to transition to a low-carbon development model represent one of the key challenges of our time. Global warming, driven by anthropogenic greenhouse gas emissions, is recognized as a fact by the scientific community. According to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC, 2023), the decade from 2011 to 2020 was the warmest in the last 125,000 years. Climate change is already having significant impacts on water resources, food security, public health, and economic activity.

The World Meteorological Organization (WMO) forecasts with 98% probability that the period 2023–2027 will become the hottest on record since the beginning of meteorological observations. These trends increase ecosystem vulnerability and require urgent and large-scale adaptation and emission reduction measures.

Alongside risks, the green transition opens substantial economic, investment, and social opportunities, fostering the development of a more sustainable and inclusive growth model. KEGOC JSC recognizes the critical role of the energy sector in achieving the global carbon neutrality goals set forth in the Paris Agreement and contributes to this process through its investment and operational activities.

Understanding the risks and opportunities related to climate change is increasingly important for stakeholders, including investors, regulators, and partners. In response, in 2024 KEGOC JSC developed and approved its Climate program for 2025-2060 (Climate program). The Climate program includes a comprehensive qualitative and quantitative assessment of climate risks and opportunities, incorporating scenario modeling, vulnerability analysis, and evaluation of financial impacts on the Company’s operations.

Climate change management

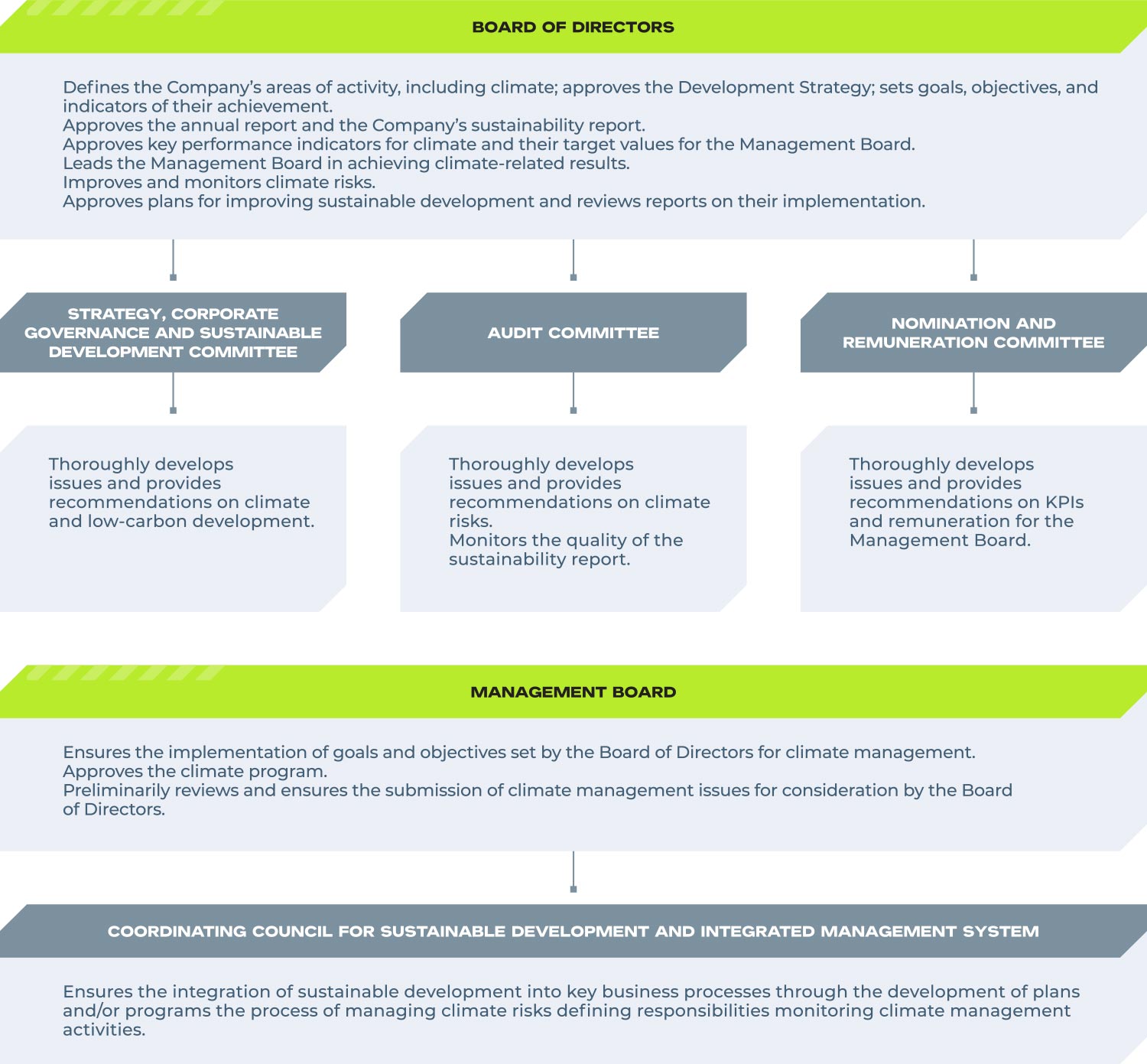

Board of Directors’ Oversight of the Climate Agenda

Climate change issues occupy a central place in KEGOC JSC’s strategic management and are integrated at all levels of corporate governance, starting from the Board of Directors and its committees. In 2024, the climate agenda was addressed through regular Board meetings and strategy sessions, including the annual approval of climate-related KPIs, as well as quarterly monitoring of the Plan’s ESG and oversight of climate risk management.

The Board of Directors defines the Company’s strategic priorities, including climate goals, approves the Annual Report containing the Sustainability Report, and sets target indicators for which the Management Board is accountable. An important function of the Board is the annual evaluation of the Executive Management’s performance, including based on functional KPIs.

The work on climate matters is supported by specialized Board committees:

- The Strategy and Sustainable Development Committee provides recommendations on climate issues;

- The Audit Committee assesses the quality of climate-related disclosures and risk management;

- The Nomination and Remuneration Committee considers the achievement of KPIs in evaluating Executive Management effectiveness.

The Board of Directors also ensures the availability of ESG and climate competencies. In 2024, the Board members attended a number of training sessions involving internal and external experts on climate risk management, new international and Kazakhstani regulatory ESG requirements, key trends in business adaptation to climate change, climate policy and sustainable development.

Role of Management Board in climate governance

The Management Board of KEGOC JSC implements the strategic goals determined by the Board of Directors, including climate change objectives, approves the Climate program, is responsible for its implementation, climate risk management and coordination of actions of all subdivisions within the framework of the unified ESG agenda.

The Coordinating council on sustainable development and the IMS, operating under the Management Board, ensures:

- integration of climate aspects into business processes and operational decisions;

- development of internal programs and plans aimed at reducing climate risks;

- assessment of climate challenges and opportunities;

- allocation of responsibilities and monitoring of implementation.

Climate risk management processes are based on the principles of double materiality, taking into account stakeholder expectations. Significant risks and opportunities are identified in the course of dialog with investors and partners, taking into account TCFD recommendations.

The Company acknowledges the need to adapt to evolving regulatory environments and reporting requirements and regularly updates its climate management approaches in response to new expectations and challenges.

Climate change governance structure at KEGOC JSC

Climate change strategy

KEGOC JSC consistently integrates the climate agenda into its strategic and operational management, recognizing the importance of sustainable development in the energy transition The Company’s climate action is based on internal documents such as the Climate Programme, as well as KEGOC JSC Low Carbon Development Programme 2031 and Vision for Carbon Neutrality 2060 (LCDP), covering decarbonization, energy saving and climate risk management goals.

Specifically, the sustainable development and carbon footprint reduction targets are embedded in the LCDP, developed in alignment with Kazakhstan’s National Strategy for Carbon Neutrality and the Low-Carbon Development Concept of Samruk-Kazyna JSC. The goal of the LCDP is to formalize approaches and tools that ensure the reduction of the carbon footprint through:

- assessment of decarbonization potential considering production specifics;

- identification of priority areas and measures for emission reduction;

- forecasting of CO₂ emissions up to 2060;

- raising climate awareness among employees and disseminating global practices in emission reduction.

Key objectives include reducing the consumption of fuel and energy resources, improving energy accounting and monitoring systems, and implementing resource-saving technologies.

The Company takes into account its role as a system operator and electric grid operator, which limits the potential for directly implementing renewable energy projects. However, KEGOC JSC actively participates in R&D and considers the deployment of pilot solutions such as energy storage systems (ESS). In 2024, the implementation of the pilot project “deployment of electricity storage systems in the unified power system (UPS) of Kazakhstan” continued. The project aims to study the impact of energy storage systems on the regulation of the UPS during the integration of renewables, in cooperation with China Power International Development Limited, China Power International Holding Limited, and the Renewable Energy Association of Kazakhstan.

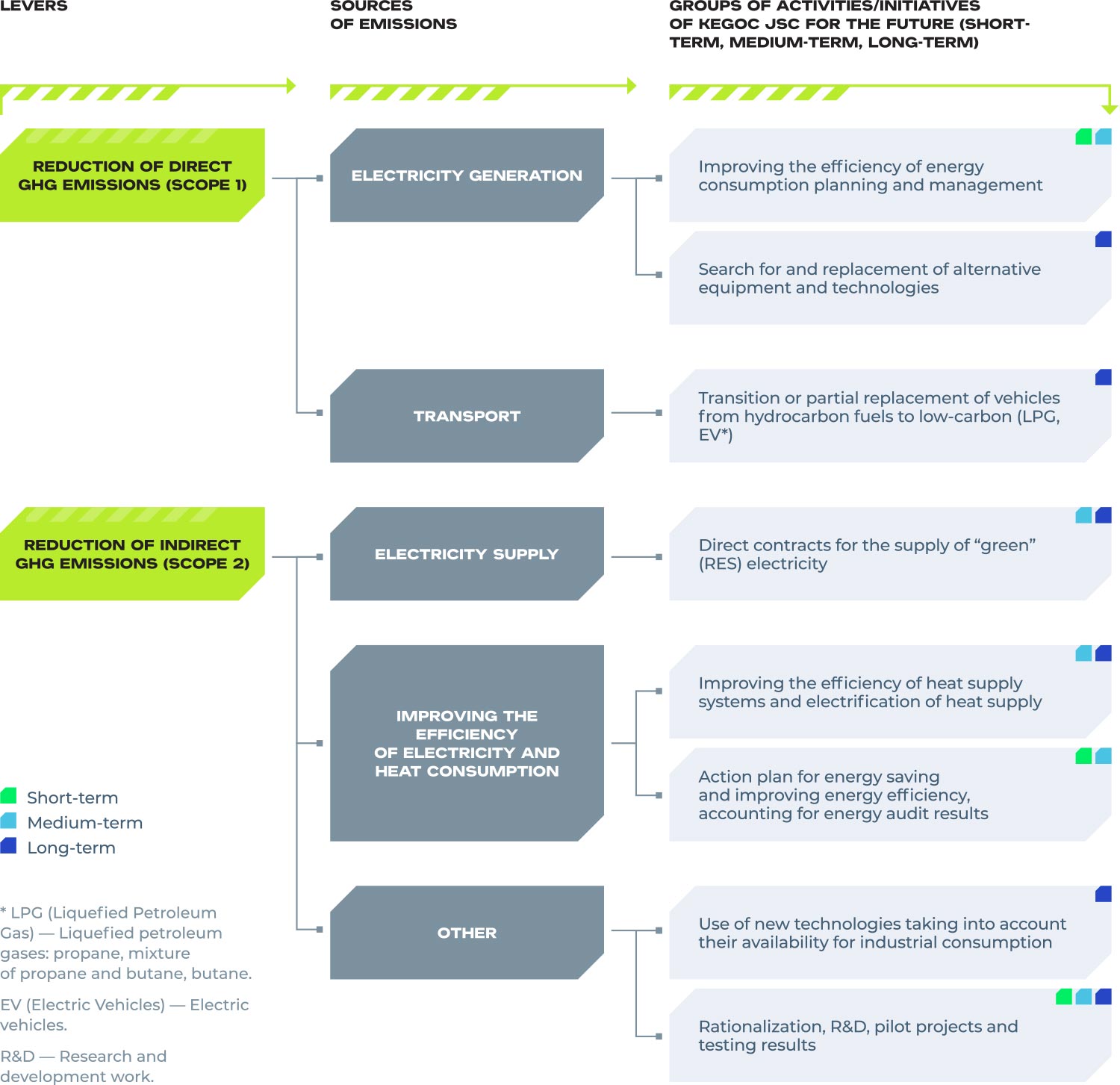

The transition to low-carbon development includes the following measures:

- gradual replacement of internal combustion engine vehicles with electric vehicles (Scope 1);

- increase in the share of procured “green” electricity (Scope 2);

- development of digital solutions (Smart Grid), conducting energy audits, equipment modernization, and promoting resource efficiency (Scope 1 and Scope 2).

- implementation of current green projects (Scope 2): Unification of the energy system of Western Kazakhstan with the UPS of Kazakhstan. Construction of power grid facilities; Strengthening of the power grid of the Southern zone of the UPS of the Republic of Kazakhstan;

- implementation of promising green projects (Scope 2): Strengthening of the external power supply scheme of Astana city. Construction of power grid facilities Enhancement of transit potential and transmission capacity of the UPS of Kazakhstan; Construction of 500 kV overhead line Karaganda — Zhezkazgan — Kyzylorda — Shymkent; Strengthening of the Western energy hub Construction of 500 kV overhead line Karabatan — Beineu — Mangystau; Unification of the Western zone with the UPS of the Republic of Kazakhstan. II stage.

Key decarbonization levers by emission sources at KEGOC JSC

Reduction of Scope 1 emissions:

- stationary source emissions: continuous monitoring of fuel combustion levels and the technical condition of equipment is carried out, as well as its upgrading in domestic and international markets. The widespread implementation of alternative technologies that are potentially available and effective will contribute to emission reductions, especially in emergency power supply situations.

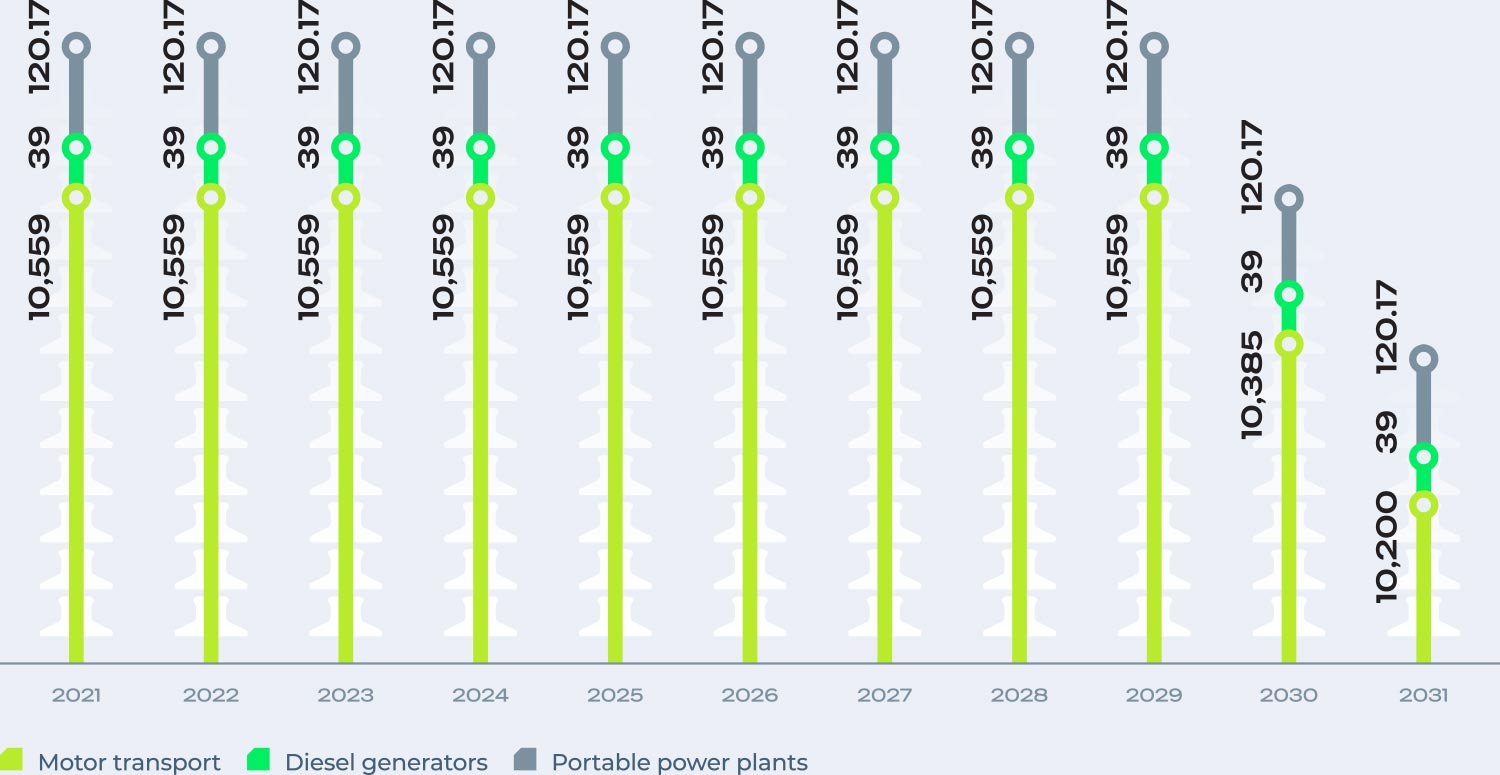

- mobile source emissions: in 2030–2031, it is planned to replace 19 passenger vehicles with internal combustion engines (out of 115 units) with electric vehicles in the Akmola and Almaty MES branches and the Executive Directorate for the transportation of production and administrative personnel. As a result of the implemented measures, a reduction in direct CO₂ emissions by 2% in 2030 and by 3% in 2031 is expected.

Expected direct emissions of KEGOC JSC until 2031, tons of CO₂

Reduction of Scope 2 emissions:

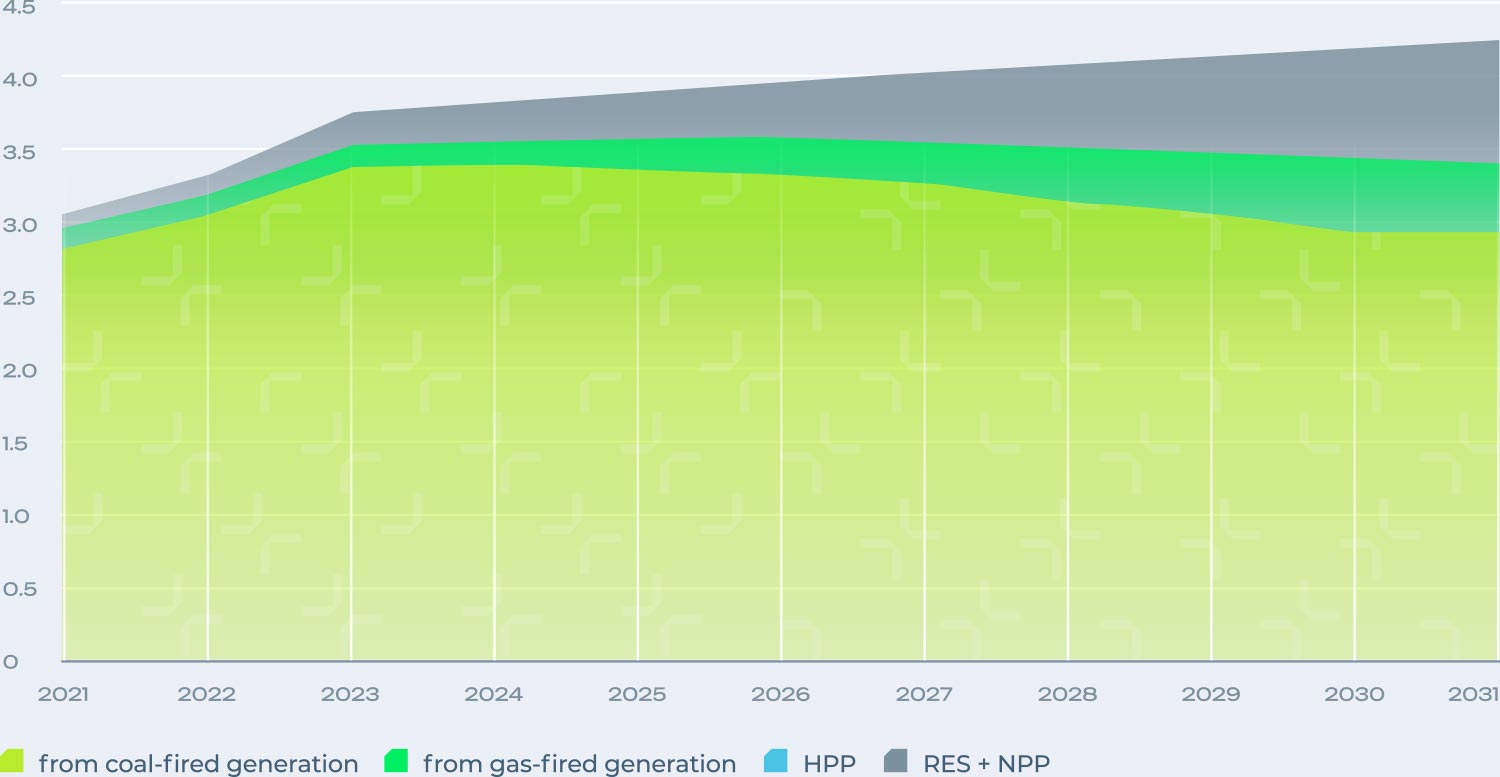

The Company purchases electricity for technological purposes, including electricity to compensate for technological electricity consumption during its transmission through the NPG of the Republic of Kazakhstan, as well as for economic needs, from the Single Buyer (SFCS of RES LLP), which in turn purchases electricity from all EPOs, including electricity generated by renewable energy facilities. By the end of 2024, the share of RES generation in the total generation volume amounted to 6.4%. The projected share of green energy in the volume of technological electricity consumption will amount to 7% by 2025, 12% by 2028, and 19% by 2032.

The Company is actively involved in improving national legislation, implementing projects for the development of NPG and ensuring conditions for the connection of RES, developing and implementing projects in the field of energy saving and energy efficiency.

Planned volumes of electricity purchases for compensation of technological consumption (Carbon Neutrality Scenario)

The main priorities of the energy efficiency and energy saving policy include:

- optimization of energy resource accounting and management systems;

- justification and standardization of target consumption indicators;

- improvement of staff competencies in energy saving;

- cooperation with external partners in implementing innovative energy-saving solutions;

- employee engagement in generating ideas and initiatives to reduce resource consumption;

- conducting energy audits and implementing corresponding measures;

- modernization of equipment with transition to energy efficient solutions, etc.

In the short and medium term, the Company is focused on implementing the Energy Saving and Efficiency Improvement Plan for 2021–2025. Priority areas include modernization of lighting systems, installation of energy-efficient boilers, replacement of windows and doors, installation of thermostats. The expected effect is a reduction in energy resource consumption by 5,000 toe.

Further development involves regular energy audits and updating five-year programs. As part of digital transformation, KEGOC JSC will implement IoT technologies, AI, and cloud solutions to enhance efficiency. In the field of R&D, the focus is on reducing technological consumption, including through robotic cleaning of wires on the 500 kV North–South overhead line. The Company intends to form a project portfolio for the medium term with the possibility of financing through the R&D fund of the “Samruk-Kazyna” group.

Stable growth of the share of electricity from renewable energy sources, as well as energy saving and energy efficiency improvement measures enable the Company to plan a gradual increase in the volume of electricity purchased from renewable energy sources and to achieve the Scope 2 emission reduction target of 20% by 2031.

Assessment of climate risks and opportunities

Climate modeling covers the period until 2060, selected in accordance with the Strategy for Achieving Carbon Neutrality of the Republic of Kazakhstan. Financial modeling of climate risks was carried out for four scenarios (RCP2.6, RCP4.5, RCP8.5, NZE 2050). It covers key aspects: revenue, OPEX, CAPEX, EBITDA, and operating profit. The analysis demonstrated the high resilience of the Company under all scenarios, including the stress scenario RCP8.5. The models took into account possible changes in regulation, electricity prices, climate parameters, and infrastructure requirements.

For each scenario, financial indicators were extrapolated to 2060 based on current data on income, expenses, capital expenditures, and EBITDA. Financial assessments are based on the full income and expense model of KEGOC JSC, taking into account climate impacts on operational and investment flows.

The Company uses scenario analysis to assess climate risks and opportunities:

- The “Carbon Neutrality” scenario assumes an increase in the share of RES, emission reduction, and the implementation of energy-efficient technologies.

- The “Business as Usual” scenario demonstrates a potential increase in costs and a decrease in competitiveness in the absence of climate reforms.

KEGOC JSC considers climate risks and opportunities over various time horizons:

- Short-term (until 2025): implementation of pilot projects such as Smart Grid, execution of the Energy Saving Plan, implementation of monitoring.

- Medium-term (until 2031): achievement of target indicators for reducing Scope 1 and Scope 2, enhancement of energy system resilience.

- Long-term (until 2060): achievement of carbon neutrality, full adaptation of infrastructure.

Climate risk assessment

Climate risks assessment covers all links in KEGOC JSC’s value creation chain. Vulnerability to temperature and flood impacts is analyzed at the stages of design of construction and modernization of NPG, power transmission, and generation forecasting, extreme weather is analyzed at the stage of equipment operation, dispatching and balancing, and emissions from stationary and mobile sources are monitored. At the consumption stage, indirect emissions from the use of electricity for technological needs are considered. In the innovation and R&D block, technological solutions are developed, including Smart Grid and PSS. At the supply management stage, suppliers are assessed according to ESG criteria, including environmental responsibility and compliance with sustainable development standards.

The assessment of physical climate risks at KEGOC JSC was conducted using a scenario-based approach through 2060 and covers key climate parameters such as temperature, floods, and extreme weather events, with a focus on the vulnerability of critical assets. The analysis is based on RCP scenarios and reflects potential consequences for the Company’s infrastructure and financial indicators.

List of indicators relevant for climate change analysis of KEGOC JSC

Temperature

Type

Chronic

Indicator/unit of measurement

Annual minimum of daily minimum temperature (°C)

Relevance for exposure risk analysis

Low temperatures may lead to equipment freezing, increased heating costs, and icing of transmission lines.

Type

Chronic

Indicator/unit of measurement

Annual maximum of daily maximum temperature (°C)

Relevance for exposure risk analysis

Higher temperatures can increase electricity consumption, overheat equipment, reduce efficiency, and accelerate wear.

Floods

Type

Acute

Indicator/unit of measurement

Flooding (m)

Relevance for exposure risk analysis

Floods can cause short circuits, damage substations, and lead to prolonged power outages.

Extreme weather

Type

Acute

Indicator/unit of measurement

Maximum wind speed (m/s)

Relevance for exposure risk analysis

Strong winds may damage overhead power lines, break poles, and cause outages due to fallen trees.

Temperature

Rising average and extreme temperatures are recognized as one of the key climate challenges. According to models, the average air surface temperature may increase by up to +58.5% by 2060 under the RCP8.5 scenario compared to the baseline. Minimum temperatures also rise 3–4 times, indicating a sharp decline in cold periods. The most significant temperature increase is observed in the Turkestan region, where by 2060 the maximum temperature may reach 22.99 °C and the minimum — 9.28 °C, exerting pressure on transformer cooling systems, accelerating equipment aging, increasing the risk of insulation failure, and reducing transmission line capacity due to overheating.

Floods

Floods pose the greatest threat in the Atyrau and Mangystau regions. By 2060, under the RCP8.5 scenario, the average flood level may reach 0.7 m in Mangystau. This creates a risk of inundation of distribution points and substations, especially in low-lying areas. Potential damages include prolonged energy transmission disruptions, equipment damage, and increased emergency recovery costs.

Extreme Weather

Despite an overall decrease in maximum wind speed of up to 2.6%, wind loads remain high in the northern and central regions. For example, in the North Kazakhstan region, even under RCP8.5, the maximum wind speed by 2060 is projected at 39.52 m/s. This necessitates regular monitoring of transmission line conditions, implementation of damping devices, and reinforcement of structures to prevent breakages and deformations.

The region’s most vulnerable to physical climate risks are Turkestan, Almaty, Karaganda, Atyrau, and Mangystau. These areas host key Company assets that are exposed to significant climate stress. Considering the specifics of the facilities, a list of priority adaptation measures has been developed for each region.

As part of climate modeling, KEGOC JSC quantitatively assessed the potential financial impacts of physical climate risks through 2060. The analysis covers two key areas: risks arising from changes in climate parameters (temperature, floods, extreme winds) and the costs of adaptation measures aimed at improving infrastructure resilience.

Without adaptation measures, cumulative financial losses from physical climate impacts (equipment overheating, substation flooding, wind damage) may reach KZT 261 billion by 2060. The cost of implementing adaptation measures (infrastructure reinforcement, monitoring implementation, cooling system modernization, deployment of intelligent control systems) is estimated at over KZT 314 billion for the period from 2030 to 2060.

Assessment of transition risks

KEGOC JSC considers transition risks as an important focus area in climate analysis. Particular attention is paid to the potential consequences of changes in public policy, regulatory requirements, technological standards, and market conditions amid the global energy transition.

As part of the climate program development, a financial assessment was conducted on the impact of key transition risks on the Company’s operational and investment activities through 2060. The assessment was carried out under four climate scenarios (RCP2.6, RCP4.5, RCP8.5, and NZE 2050), taking into account parameters such as revenue, operating and capital expenditures, EBITDA, and operating profit.

The most significant risks are associated with stricter energy efficiency standards, rising electricity costs, and the need to comply with new ESG requirements. Although KEGOC JSC is not a subject to emissions quotas and does not directly participate in the carbon market, regulatory changes affect the cost of purchased energy and drive the need for large-scale infrastructure modernization.

The analysis determined that in order to ensure compliance with new standards and improve energy efficiency, investments of approximately KZT 90 billion will be required by 2060. In the absence of such measures, the financial impact may reach KZT 138 billion starting from 2030. These estimates account for both direct costs of technological upgrades and indirect expenses related to increased tariff pressure and regulatory constraints.

One of the priority measures under the strategy is the implementation of advanced digital solutions and smart grid technologies aimed at improving transparency and efficiency in electricity transmission. These technologies help reduce operating costs, enhance power supply reliability, and ensure compliance with growing climate expectations from investors and regulators.

Climate opportunities assessment

KEGOC JSC considers climate change not only as a source of risks, but also as a significant opportunity to improve sustainability, technological modernization and investment attractiveness. The assessment of climate opportunities covers such areas as implementation of energy efficient solutions, application of intelligent energy management systems and implementation of pilot projects in the field of energy storage.

One strategically important opportunity is the development of smart infrastructure. A pilot project to install a 5 MW PSS in southern Kazakhstan will explore the potential to increase system flexibility, integrate renewables and improve peak load management. In the long term, this is the basis for scalable solutions for modernization of the energy system at the national level.

In addition, KEGOC JSC pays special attention to energy efficiency improvement within the framework of the existing energy saving programs, infrastructure modernization and implementation of digital solutions. The Company has a system in place to motivate personnel to put forward rationalization proposals, and R&D activities are aimed at developing solutions to reduce technological losses in energy transmission.

According to the calculations of the Climate program, the potential annual economic benefit from leveraging climate opportunities is estimated at KZT 5–10 billion per year starting from 2031. These benefits are driven by reductions in technological electricity losses, lower operational costs, improved energy efficiency, and a decreased risk of emergency outages. At the same time, annual investments in these areas are projected at KZT 4 billion, beginning in 2030.

Key financial impacts of climate risks

Potential financial impacts of physical risks:

- Asset damage and loss

- Disruptions in the supply chain

- Higher operational costs

- Unexpected recovery and repair costs

- Limited access to resources

- Decline in asset value

- Business interruption and forced downtime

Potential financial impacts of transition risks:

- Asset devaluation

- Increased costs of compliance with new regulations

- Rising capital costs due to policy changes

- Reduced demand for carbon-intensive goods and services

- Increased costs of modernization and technology adaptation

- Shifts in market conditions and competitiveness

- Transformation of the energy market

- Risk of litigation and reputational damage

- Restricted access to ESG-focused investment

Climate change risk management

KEGOC JSC has implemented and is continuously developing a risk management system based on the principles of the integrated COSO ERM model and the corporate requirements of Samruk-Kazyna JSC. The Corporate Risk Management System (CRMS) is a key component of the Company’s corporate governance framework and is aimed at timely identification, assessment, and management of risks that may affect the achievement of strategic and operational goals.

The purpose of the CRMS is to ensure business continuity and resilience by minimizing the impact of external and internal factors, including climate change. Climate risk management is integrated into the overall system: such risks are identified, assessed, and, where necessary, quantitatively analyzed based on their potential financial impact. The assessment process takes into account both current and anticipated regulatory requirements, including international standards such as GRI, SASB and ESRS.

The Board of Directors exercises overall oversight of the risk management system, approves key documents, and sets the “tone at the top” regarding risk governance. The Audit Committee under the Board of Directors monitors the effectiveness of CRMS, including climate risk management. Documents submitted to the Board of Directors for approval are first reviewed by this committee.

KEGOC JSC also considers climate and environmental risks in its engagement with suppliers. During the selection of counterparties, due diligence procedures are applied, including questionnaires, assessment of compliance with environmental requirements, and analysis of public restrictions. Contractual terms include supplier obligations to comply with applicable standards in environmental protection, sustainable development, and safety.

Climate-related opportunities are viewed as an integral part of KEGOC JSC strategic development. The advancement of sustainable infrastructure, implementation of green projects, improvements in energy efficiency, and support for national climate policy contribute to risk reduction and the creation of long-term value for all stakeholders.

Processes for identifying and assessing climate risks

Categories of climate risks and opportunities

Transitional Risks

- Policy and Regulation

- Technology

- Market

- Reputation

Physical Risks

- Acute

- Chronic

Opportunities

- Resource Efficiency

- Energy Sources

- Products and Services

- Markets

- Sustainability

At KEGOC JSC, climate risks are classified as physical (acute and chronic) and transition risks (related to policy, markets, technology, and reputation). Climate risk identification considers their potential impact on the Company’s assets, operations, and financial performance. Priority is given to risks that may affect the long-term sustainability or the achievement of KEGOC JSC’s strategic objectives.

To assess the scale and significance of these risks, KEGOC JSC applies an adapted methodology based on the analysis of:

- the geographical location of assets;

- climate scenarios (RCP 2.6, 4.5, 8.5, and NZE 2050);

- projected climate impacts;

- historical climate data (including the Climate Change Knowledge Portal and Kazhydromet RSE);

- the sensitivity of key facilities to climate change;

- potential financial consequences, including the impact on EBITDA, operating expenses, and recovery costs.

Physical Risks

The identification process for physical climate risks is based on climate change scenario analysis using both international and national sources, including IPCC climate models (RCP2.6, RCP4.5, RCP8.5), International Energy Agency scenarios (IEA NZE 2050), as well as long-term forecasts provided by Kazhydromet RSE.

An assessment was conducted for 83 SS and infrastructure facilities of KEGOC across two main categories of physical risks:

Acute Risks

Floods and inundations that may lead to substation flooding, equipment damage, and power supply disruptions; hurricanes, squalls, and thunderstorms that may result in the destruction of power line supports, conductor breaks, and widespread outages; heavy snowfall and ice storms that lead to ice accumulation on overhead lines, increased structural loads, and higher accident rates.

Chronic Risks

Rising average annual temperatures, which increase thermal load on equipment, lead to higher energy losses in networks, and accelerate asset wear; changes in precipitation and humidity patterns, which may affect soil stability, cause structural corrosion, and require additional infrastructure reinforcement; longer heatwave periods, increasing the need for equipment cooling and maintenance costs; and higher levels of corona losses due to elevated humidity and temperature, especially in southern and Caspian regions.

The risk assessment was carried out using a multi-criteria analysis methodology that includes:

- probabilistic assessment of climate event occurrence (based on meteorological scenarios up to the year 2100);

- vulnerability assessment of specific infrastructure facilities;

- determination of potential impacts on the Company’s operations and system performance.

Additionally, regional risk stratification was conducted to reflect Kazakhstan’s geographic and climatic heterogeneity, allowing identification of the most sensitive zones: south — susceptible to thermal risks, west — prone to flood risks, central and eastern regions — exposed to complex climate impacts.

Value chain and associated climate risks of KEGOC JSC

Operations

Risk category

Chronic

Subcategory

Increased humidity and precipitation

Detailed description of climate risk

Higher precipitation levels may affect infrastructure stability and require additional protective measures against soil erosion.

Illustrative impact description

- Service disruptions due to equipment damage and malfunctions

- Increased costs for infrastructure reinforcement

- Risk of corrosion of metal components

- Increased “corona” losses

Risk category

Acute

Subcategory

Floods

Detailed description of climate risk

Floods and inundations can submerge substations, causing equipment damage and disruptions to the power system.

Illustrative impact description

- Power supply interruptions, especially critical in high-consumption areas

- Increased operational costs for repair and equipment recovery

Risk category

Chronic

Subcategory

Extreme weather (wind loads)

Detailed description of climate risk

Strong winds and hurricanes may cause conductor breaks and support structure damage, resulting in transmission disruptions.

Illustrative impact description

- Prolonged power supply interruptions

- Impact on power system stability

- Increased repair and recovery costs

Operations and Infrastructure

Risk category

Chronic

Subcategory

Temperature

Detailed description of climate risk

Continuous temperature increases lead to higher loads on transmission lines and equipment, causing overheating and accelerated aging.

Illustrative impact description

- Emergency outages

- Additional maintenance resources

- Increased electricity losses due to load growth

Infrastructure

Risk category

Chronic

Subcategory

Temperature

Detailed description of climate risk

High temperatures can affect transformer cooling systems, increasing the risk of failure.

Illustrative impact description

- Frequent shutdowns for cooling

- Reduced transmission efficiency (losses during power transmission through the grid)

Transitional risks

KEGOC JSC conducts a systematic assessment of transitional climate risks in line with the TCFD recommendations and the requirements of IFRS S1 and S2 standards. The analysis is conducted regularly, taking into account the specifics of the power transmission sector and the current regulatory landscape. The Company identifies legal, technological, and market risks as key categories of transitional risks.

Legal risks

The transition to a low-carbon economy is accompanied by an increase in climate-related regulation. In identifying legal risks, KEGOC JSC considers potential legislative changes, including the establishment of emission standards, implementation of internal and external carbon pricing mechanisms, and expanded ESG disclosure requirements. These changes may lead to additional financial and operational costs, including investments in infrastructure modernization and strengthening compliance processes.

Another significant source of legal risks is the growing number of climate-related lawsuits globally. This trend increases the demand for transparency in reporting and verifiable actions on climate risk management, leading to heightened scrutiny of the accuracy of ESG data and disclosures.

Technological risks

KEGOC JSC monitors technological trends that contribute to reducing GHG emissions, including the development of RES, energy storage systems, and digital solutions. Despite their potential to increase efficiency, these technologies require significant investments, modernization of operational processes, and adaptation of the grid infrastructure. The Company considers potential risks related to delayed implementation of technological solutions, technological obsolescence, or limited availability of innovations necessary for achieving climate goals.

Market risks

The formation of sustained demand for “green” energy and consumer preferences for low-carbon solutions impact the market environment. KEGOC JSC considers shifts in consumer expectations, partner requirements, and financing conditions as factors that may affect demand, capital cost, and the Company’s position in the value chain. These risks require business model adaptation, operational transformation, and enhancement of investment appeal through active participation in the climate agenda.

Climate Program

In 2024, KEGOC JSC approved its Climate Program for 2025–2060, a key strategic document for climate risk management. The Program aims to ensure the resilience of power transmission infrastructure to changing climate conditions and is aligned with international standards, including TCFD recommendations and climate scenarios from the IPCC and IEA.

The document includes an assessment of physical and transitional risks, modeling of the impacts of various climate scenarios on 83 substations, asset vulnerability analysis, and identification of priority adaptation measures. The Program reflects the specifics of the energy sector, taking into account the geographic distribution of assets and KEGOC JSC’s systemic functions.

Climate risks are integrated into the Company’s unified corporate risk register, assessed at the subsidiary level, and transferred to the Centralized Risk Management Center. Risks are classified, assigned a status (acceptable or requiring response), and accompanied by control measures.

The Board of Directors of KEGOC JSC provides strategic oversight in this area, the Audit Committee reviews risks as part of non-financial reporting, and the Management Board, with the participation of the Sustainable Development Coordination Council and IMS, is responsible for implementing the Program’s provisions.

Climate change metrics and targets

GRI 305-1, 305-2, 305-4, 305-5

KEGOC JSC most significant contribution to environmental protection, as an electric grid company and System Operator, is to contribute to the decarbonization of the economy of the Republic of Kazakhstan through the integration of RES into the country’s UPS.

Integration of the low-carbon agenda allows KEGOC JSC not only to fulfill the role of System Operator for technical connection of RES, but also to strengthen investment attractiveness, meet investors’ expectations and demonstrate sustainable climate ambitions.

Greenhouse gas inventory

KEGOC JSC performs an annual GHG inventory based on internationally recognized approaches—the 2006 IPCC Guidelines, the Greenhouse Gas Protocol, and the Paris Agreement provisions. The GHG inventory report is consolidated at the corporate level using the operational control approach to define organizational boundaries. In 2022, the Company prepared its first comprehensive report under these standards and established 2022 as the baseline year. The baseline year is subject to recalculation if the methodology changes, the scope of sources expands, or input data are refined.

The inventory includes CO₂, CH₄, N₂O, and SF₆ gases, with global warming potentials determined according to the IPCC Fifth Assessment Report (AR5).

The main Scope 1 direct emissions sources include:

- mobile sources — vehicles used for operational and maintenance activities;

- stationary sources — generators and power plants used in emergency or maintenance scenarios;

- SF₆ circuit breakers operated at substations.

Emissions from air conditioning systems were excluded from the calculation due to their insignificant volume and lack of reliable data.

The Scope 2 indirect energy emissions include:

- emissions from electricity consumption for technological and operational needs, including transmission losses in the NPG;

- emissions from consumed thermal energy.

Scope 3 emissions were not included due to insufficient data.

Analysis of GHG emissions

KEGOC is not subject to national greenhouse gas quotas, as the emission volumes are below the thresholds established by the Environmental Code of the Republic of Kazakhstan. Nevertheless, the Company voluntarily conducts a full inventory of greenhouse gas emissions in accordance with international obligations (UN Framework Convention on Climate Change, Kyoto Protocol, Paris Agreement) of the Republic of Kazakhstan and corporate goals on carbon footprint reduction.

Greenhouse gas emissions indicators for 2024

GRI 305-1, 305-2

| Emissions | Total (tCO₂-eq) | CO₂ (t) | CH₄ (tCO₂-eq) | N₂O (tCO₂-eq) | SF₆ (tCO₂-eq) |

|---|---|---|---|---|---|

| Scope 1 | 13,491.04 | 10,036.86 | 49.33 | 129.67 | 3,275.20 |

| Scope 2 | 2,357,187.40 | 2,357,187.40 | - | - | - |

Emissions indicators, tons of CO₂ equivalent

GRI 305-1, 305-2

| Emissions | 2022 | 2023 | 2024 |

|---|---|---|---|

| Scope 1 | 8,887 | 10,339 | 13,491 |

| Scope 2 | 2,692,188* | 2,524,980* | 2,357,187 |

| Total | 2,701,075 | 2,535,319 | 2,370,678 |

* The Scope 2 greenhouse gas emissions for 2022 and 2023 disclosed in the 2024 report were recalculated using the market-based method to ensure comparability with 2024.

Direct emissions are primarily generated by motor vehicles used in production and maintenance activities, as well as stationary and portable generators employed for emergency power supply. An additional source of emissions may be SF₆ leaks from high-voltage circuit breakers at 110–500 kV substations.

In 2024, direct greenhouse gas emissions (Scope 1) amounted to 13,491 tons of CO₂ equivalent, which is 3,152 tons more than in 2023. The increase was due to two technical incidents: the destruction of one SF₆ circuit breaker and a leak from the sealing rings of the drive mechanism of another, caused by a design defect. In both cases, inquiries were sent to the manufacturers to obtain explanations and prevent similar incidents in the future.

KEGOC JSC uses modern SF₆-based equipment from ABB, Siemens, and General Electric, known for their high reliability. Operations are carried out by qualified personnel in strict accordance with regulations. From 2020 to 2024, the average SF₆ leakage rate was 0.11% per year. Currently, there are no alternatives to SF₆ circuit breakers in the 220–500 kV voltage class. Vacuum circuit breakers at 110 kV have not yet seen widespread adoption and are not used by the Company, although their implementation is being considered. At the same time, KEGOC is gradually reducing the use of SF₆ in 35 kV equipment by installing vacuum circuit breakers during substation upgrades.

The main volume of Scope 2 emissions is associated with electricity purchased to compensate for technological losses in the transmission of electricity via the National Power Grid. These losses are inevitable and depend on several factors, including the volume of transmitted electricity, the length and configuration of transmission lines, climatic conditions, and parallel operation with neighboring power systems. While complete elimination of these losses is not possible, the Company implements measures to optimize the operating modes of the Unified Power System of the Republic of Kazakhstan, which help reduce electricity losses. Reductions in electricity consumption for operational needs are achieved through the implementation of the 2021–2025 Energy Saving and Energy Efficiency Action Plan. These measures, along with the increasing share of renewable energy generation, contributed to emission reductions during the reporting year.

Indirect emissions (Scope 2) in 2024 amounted to 2,357,187 tons of CO₂ equivalent, down by 167,793 tons or 6.64% compared to 2023.

It should be noted that on July 1, 2023, there was a change in the electricity procurement system of the Republic of Kazakhstan, with a transition from the purchase of electricity from energy supplying organizations to purchase from the Single Purchaser. Also, since the end of 2021, the official network emission factor has ceased to be updated. Therefore, the Company recalculated Scope 2 values for 2022-2023 and also calculated Scope 2 for 2024 using market-based methodology using shares of electricity generation by fuel type from the Single Buyer (see Table 33). Currently, this method provides a more accurate assessment of the Company’s carbon footprint and corresponds to the unified approaches adopted in the group of companies of Samruk-Kazyna Fund.

Thus, despite an increase in electricity supply to the grid and the corresponding rise in electricity losses, Scope 2 emissions are decreasing due to the Company’s energy-saving and energy-efficiency efforts, as well as the growing share of renewables in the energy mix (from 3.6% in 2021 to 6.4% in 2024).

Total greenhouse gas emissions under Scope 1 and Scope 2 for 2024 amounted to 2,370,678 tons of CO₂ equivalent, which is lower than in 2022 and 2023. The overall reduction in the Company’s carbon footprint was primarily driven by a significant decrease in indirect emissions.

GHG emission intensity in 2022–2024

GRI 305-4

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Total greenhouse gas emissions (Scope 1 and Scope 2), tCO₂-eq | 2,701,075 | 2,535,319 | 2,370,678 |

| Total revenue, thousand KZT | 217,255,600 | 252,136,383 | 319,905,932 |

| Total GHG emissions intensity (Scope 1 and Scope 2), tCO₂-eq/thousand KZT | 0.012 | 0.010 | 0.0074 |

In the reporting year, the total GHG emissions intensity (Scope 1 and Scope 2) amounted to 0.0074 tCO₂-eq/thousand KZT, representing a 26% decrease compared to 2023, which is attributable to the reduction in total GHG emissions (Scope 1 and Scope 2).

Measures that reduced greenhouse gas emissions fall under Scope 2 and included measures to reduce electricity and heat consumption. When calculating GHG emission reductions, the same methodology, standards were used, the same gases were included, and the same base year was selected as in the calculation of GHG emissions for 2024.

GHG emissions reductions as a result of energy saving and energy efficiency measures

GRI 305-5

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| GHG emissions reduction, tCO₂-eq | 3,133.11 | 8,648.94 | 9,045.42 |

Climate change targets

KEGOC JSC has established quantifiable GHG emission reduction targets as part of its LCDP through 2031, which was approved in 2024. These mid-term targets cover both direct (Scope 1) and indirect (Scope 2) emissions, reflecting the Company’s commitment to sustainable development principles and climate obligations in line with national and international strategies:

- For Scope 1, the target is to reduce emissions by 2% by 2030 through the gradual replacement of internal combustion engine passenger vehicles with low-carbon alternatives, primarily electric vehicles and vehicles powered by liquefied petroleum gas.

- For Scope 2, the goal is to achieve a 20% share of “green” electricity in the purchased energy mix by 2031. This target will be achieved by increasing the share of RES in the national energy balance and applying the market-based method for calculating indirect emissions, which reflects the actual structure of procured electricity.

The results of implemented measures already confirm the effectiveness of the adopted strategy: by the end of 2024, the Company reduced its total emissions by 9,045.42 tCO₂-eq. This outcome demonstrates the feasibility of the established targets and provides a strong foundation for further advancing the climate agenda.

In addition to reducing its own emissions, KEGOC JSC joined the global Utilities for Net Zero Alliance (UNEZA), officially launched at COP28 in Dubai with the support of IRENA and the UN Climate Champions. The Alliance unites 25 leading global utilities serving more than 250 million consumers, with the goal of accelerating the energy transition and achieving carbon neutrality by 2050. As part of UNEZA, KEGOC JSC will contribute to the development of RES-ready grids, modernization of energy infrastructure, and enhancement of international cooperation to eliminate decarbonization barriers. The Company’s participation in the Alliance underscores its commitment to fulfilling the climate objectives outlined in the national Carbon Neutrality Strategy and the corporate Carbon footprint reduction program.

Climate targets are considered by the Company as a key element of its strategic transformation, and KEGOC plans to regularly review its targets in light of technological innovations, policy developments, and changes in the energy market structure.